Required documents for Self-employed person of borrower and guarantor

- Copy of Hong Kong Identity Card/ Passport

- The latest proof of home address

- Prelim (Preliminary Agreement for Sale and Purchase)

- Valid Business Registration

- Practicing Certificates (for professionals)

- Latest tax demand note

- Latest audited financial statements (If any)

- Bank book / statements showing average net capital flow for the past six months

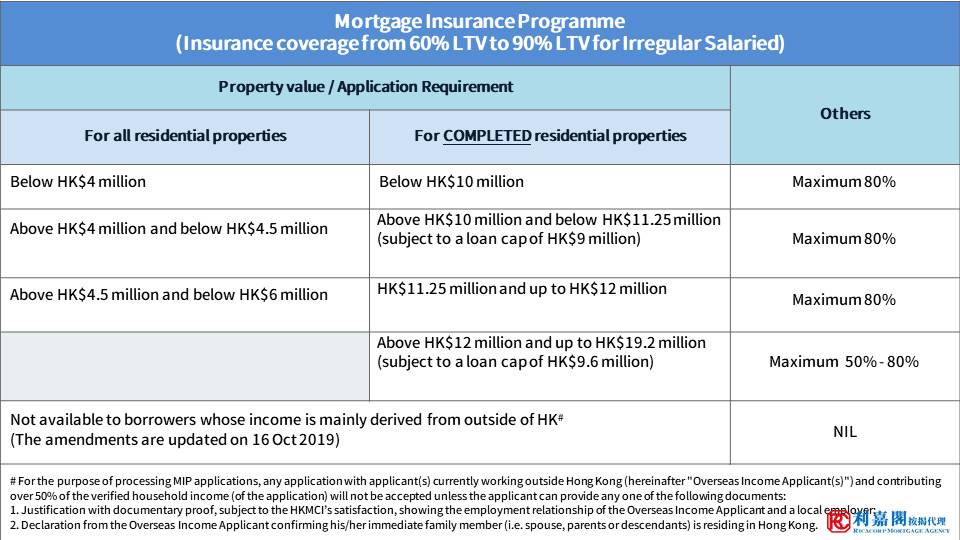

Reminder for Mortgage Insurance Programme

-

Eligible Property: Residential properties

-

Borrower Type: Personal Customers

-

Use of Property: Owner-occupied

-

LTV ratio above 80%: applicant(s) should be regular salaried first-time homebuyers

-

Debt-to-Income ratio (DTI): The limit on DTI of the total monthly repayment amount for the borrower should not exceed 50% of total income per month, and banks should stress-test mortgage applicants’ repayment ability, assuming an increase in mortgage rates of at least three percentage points, and limit the stressed DTI to a cap of 60%.

-

Premium rates: Single and annual premium payment option, no premium refund arrangement under annual premium payment option.

-

Premium rates: Single and annual premium payment option, no premium refund arrangement under annual premium payment option.

-

The sum of age of borrower and loan tenor: Bank will usually specify that the sum of age of borrower and loan tenor should not exceed 75 years, while loan tenor should not exceed 30 years.

-

The sum of property age and loan tenor: Bank will usually specify that the sum of property age and loan tenor should not exceed 75 years, while loan tenor should not exceed 30 years. (Remarks:For Village House Mortgage, the maximum sum of “Original/ Remaining Term To Maturity” and “Age of Property” should not exceed 55 years , while loan tenor should not exceed 30 years.)