WHAT'S NEW

WHAT'S NEW

Untitled-1_Ricacorp_1120x410

1111_Home-banners-MarcoFu-Ricacorp30off-01_1120x410

Pet_Banner_Ricacorp_1120x410

按揭專家_1120 x 410 (1)

banner_mobile_2

If you have any feedback, please contact us through the following method:

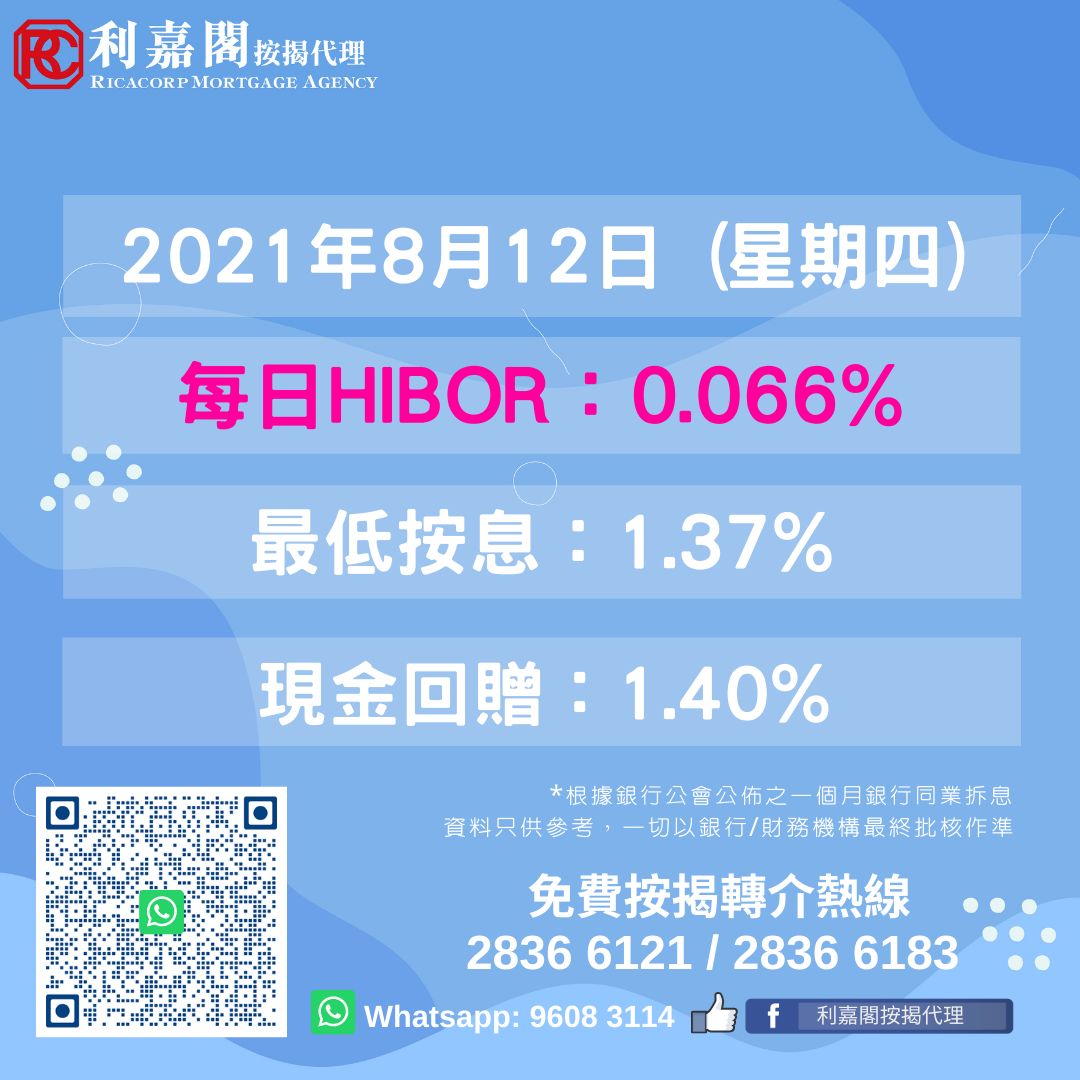

Hotline:2836 6121 / 3103-5656

Address: 14/F., CENTRE POINT, 181-185 GLOUCESTER ROAD, WANCHAI, H.K.

Email: enquiry@ricacorp.com / cs@ricacorp.com

隱私和Cookies政策

Privacy Overview

This website uses cookies to improve your experience while you navigate through the website. Out of these cookies, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. We also use third-party cookies that help us analyze and understand how you use this website. These cookies will be stored in your browser only with your consent. You also have the option to opt-out of these cookies. But opting out of some of these cookies may have an effect on your browsing experience.

Necessary cookies are absolutely essential for the website to function properly. This category only includes cookies that ensures basic functionalities and security features of the website. These cookies do not store any personal information.

Any cookies that may not be particularly necessary for the website to function and is used specifically to collect user personal data via analytics, ads, other embedded contents are termed as non-necessary cookies. It is mandatory to procure user consent prior to running these cookies on your website.